Strategic Investing in a Shaky 2025 Economy

Strategic Investing in a Shaky 2025 Economy

Blog Article

Navigating 2025: Strategies for Market Volatility

Unpredictability is nothing brand-new to financiers, however 2025 is toning up to be among the much more complicated years in current memory. With moving economic policies, progressing modern technology sectors, and worldwide events remaining to surge with the economic system, taking care of financial investments has actually come to be both extra challenging and much more essential than ever before. For those aiming to maintain and expand their wide range, recognizing just how to browse market volatility is no longer optional-- it's crucial.

Why 2025 Is Unique for Investors

Every year brings its own collection of obstacles, however 2025 sticks out as a result of the sheer quantity of adjustment taking place across markets. From rate of interest variations to the fast innovation of expert system, there are several relocating parts affecting the financial landscape. Capitalists must manage both the short-term noise and the long-lasting effects of these developments. This implies adjusting not only just how portfolios are built, but also exactly how they are kept.

Unlike previous years where an easy buy-and-hold approach can bring you through, 2025 calls for an extra nuanced technique. It's a time when active decision-making and regular reassessments become important. Markets are shifting much faster, and the typical markers of performance and threat are developing.

The Psychology Behind Market Reactions

Much of market volatility can be mapped back to capitalist habits. Psychological reactions-- driven by anxiety, greed, or uncertainty-- commonly lead to quick decisions that may not line up with lasting objectives. It's usual to see investors pulling money out of the market after a dip, just to lose out on a rebound quickly after.

Comprehending this behavior dynamic is just one of the initial steps to effectively navigating volatility. When you acknowledge the psychological triggers behind market actions, you're far better furnished to react with reasoning as opposed to impulse. This suggests remaining spent when it makes good sense and making changes just when they are based on thoughtful analysis rather than short-term panic.

The Role of Strategic Asset Allocation

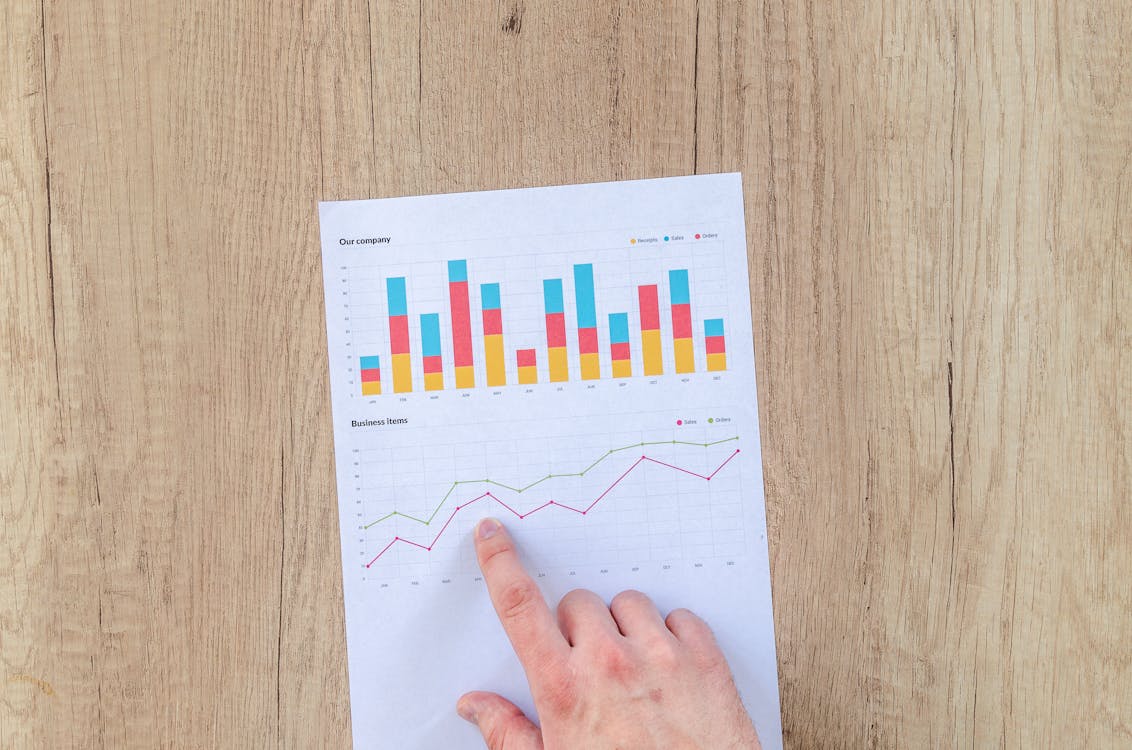

One of the most effective tools for handling market turbulence is strategic asset allocation. It's a method rooted in lasting planning and diversification, enabling capitalists to spread risk across different property courses. This strategy helps soften the strike during slumps while still supplying growth chances when markets recuperate.

In 2025, strategic asset allocation comes to be a lot more essential as relationships in between property courses remain to change. What was as soon as a reliable hedge may no more offer the exact same security. That's why routine portfolio reviews and updates are vital. Allowances that operated in the past may not serve the very same objective today.

By concentrating on the general structure of your investments, rather than look at this website individual choices, you maintain a more comprehensive sight of your monetary picture. This top-down viewpoint aids anchor decisions, specifically when headlines are chaotic or market swings are severe.

Structure Resilience Through Financial Planning

Beyond profile style, having a solid economic strategy is what allows capitalists to weather storms. This consists of having a clear understanding of cash flow, emergency situation books, tax effects, and long-lasting objectives. A plan provides instructions and keeps you based when markets throw curveballs.

For those handling significant wide range, custom-made planning ends up being important. This is where high net worth financial advisors play a crucial role. Their capability to produce customized strategies, expect complicated economic demands, and adjust to fast-changing environments provides customers a substantial benefit.

It's not nearly what's in your portfolio-- it's about just how that portfolio fits into your larger monetary life. This includes retired life timelines, family demands, philanthropic objectives, and even the prospective sale of a service or realty holdings. With this alternative view, you're less likely to be thwarted by temporary sound.

Staying Flexible Without Losing Focus

Flexibility doesn't mean deserting your approach. It indicates having the capability to pivot when required while staying rooted in your core financial objectives. In 2025, this balance is essential. With sectors fluctuating more unpredictably, capitalists have to stay sharp and available to change.

That can indicate changing direct exposure to specific industries, approaching much more protective settings, or incorporating different investments. Whatever the instance, decisions need to always be secured in your personal threat tolerance and economic timeline.

Those who stay disciplined yet versatile are frequently the ones that come out ahead. They're not attempting to time the marketplace, yet they understand the cycles and ready to act when the information sustains a move.

Regional Perspective, Global Awareness

Financial uncertainty doesn't run in a vacuum cleaner. What occurs abroad impacts neighborhood investments, and vice versa. That's why having accessibility to specialists who comprehend both the macro and the mini is essential. For instance, wealth management in Houston, TX typically needs expertise of power markets, property fads, and local financial changes-- but it also must consider global events like inflationary pressures in Europe or policy changes in Asia.

A well-rounded approach make up this. It links regional insights with broader international patterns to produce a balanced and informed strategy. That's where the genuine value exists-- not in responding to the headlines, but in recognizing what those headlines actually suggest for your monetary future.

Moving Forward With Confidence

No person can anticipate the future with absolute assurance, however that does not indicate we move thoughtlessly through it. The trick is preparation, viewpoint, and partnership. While the marketplace will constantly have its ups and downs, the ideal attitude and technique can aid you not just endure, but prosper.

Continue following the blog site for even more insights right into navigating intricate financial atmospheres, and examine back on a regular basis for fresh point of views made to keep your plan straightened with today's fast-moving markets.

Report this page